Background

Humentum worked with Luminate’s partners in 2019, supporting the organizations to think strategically about financial management and helping to build financial systems and processes that allow them to be sustainable in the long term. This case study relates to the mentoring support provided to one of their partners—the Public and Private Development Centre (PPDC), a national-level organization in Nigeria—between 2019-2020. The following overview demonstrates Humentum’s long-standing expertise and unique mentoring model.

About PPDC

Established in 2003, PPDC is a citizen sector organization (CSO) that advocates for a more transparent and accountable government with citizens empowered to participate actively in governance processes. PPDC collaborates with local partners to provide pathways for citizens to participate in governance at all levels using technology-based tools. PPDC also carries out cutting-edge research, data mining, analysis, and visualizations.

Examples of PPDC’s work:

- PPDC has successfully advocated adopting the Open Contracting Data Standards (OCDS) and currently leads the charge in demanding its full implementation across all states in Nigeria. Through its Budeshi platform, PPDC aims to minimize the challenges of access to procurement data, serving as a hub for citizens to access this data in digital and easy-to-use formats.

- The Access to Information program focuses on improving the disclosure of publicly held information through sustained compliance with the principles of the Freedom of Information Act 2011.

- The HomeVida Initiative aims to influence the content of Nigerian filmmaking with integrity values while providing incentives for young filmmakers.

- The Digital Inclusion and Safer Internet program focuses on promoting access to digital technology while preserving safety and freedom on the internet.

The Challenge

As a growing CSO, PPDC sought support to help it meet global best practices. Humentum assessed PPDC’s financial management policies, procedures, and organizational capabilities to identify areas for improvement and enhance staff capacity through mentoring support. Examples of the critical financial management gaps addressed included the need to:

- Strengthen financial planning, monitoring, and reporting

- Establish standard accounting records, accounting roles and responsibilities, and an internal control system

Upon completing the mentoring support, PPDC expected to clearly understand the financial planning cycle, equipped with the skills and knowledge to make the best use of standard tools, such as cash flow forecast, activity-based budgeting, etc. Another goal included ensuring PPDC could identify and efficiently maintain books of accounts and relevant supporting documents for all related financial transactions. A final objective involved effective management of budgets and preparation of relevant financial monitoring reports.

The Humentum Solution

Humentum has established success in supporting international and national-level NGOs by improving financial management practices and processes. Humentum employed a blended approach, using on-the-job mentoring/coaching as well as face-to-face and remote training modules, including:

- Understanding Financial Management Concepts and Principles

- Understanding Financial Management Roles and Responsibilities

- Financial Planning for Effective Project Implementation

- Understanding Key Accounting Records

- Project Financial Monitoring and Reporting

- Effective Internal Control Systems to Safeguard Project Resources

- Fighting Fraud in NGOs

- Understanding Risk Management Framework and Principles

This tailored approach assisted PPDC in implementing an appropriate corrective action plan to bridge the specific gaps identified during a benchmarking assessment (highlighted below).

First, PPDC was assessed via the Humentum Health Check questionnaire. This tests an organization’s alignment with basic financial management best practices, as per the following key areas:

- Financial planning

- Accounting records

- Financial reporting

- Internal control

- Grants management

- Staffing

Then, an action plan was jointly developed with PPDC and implemented over six months, supporting management and staff during that time.

The Humentum support and training received by PPDC management and team members enhanced the structuring of our financial management and internal control process. The simplicity of their training content and the trainer’s knowledge transferability made the sessions very impactful. The periodic webinars contributed tremendously to our strategic planning. For instance, the financial sustainability webinar was instrumental to our cost planning and reserve sustainability. – Nkemdilim Ilo

Results

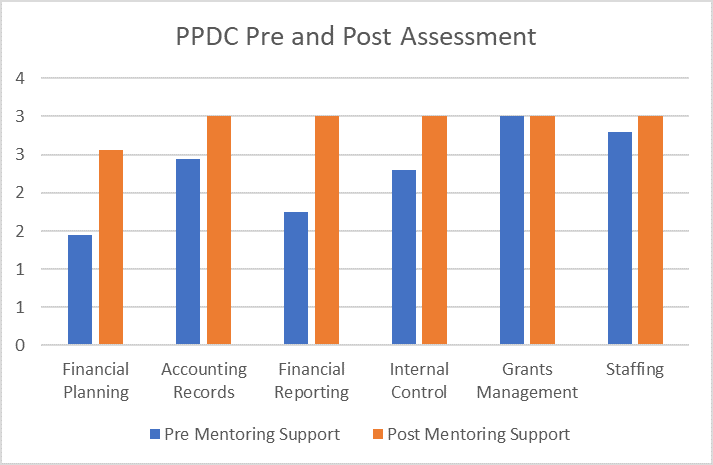

Through Humentum’s participatory approach, PPDC addressed the financial management challenges identified in the assessment. The chart below highlights the impact of pre to post-mentoring support.

The immediate benefits included:

- PPDC has a better understanding of financial management roles and responsibilities among its staff.

- PPDC has noted improved financial reporting following the complete migration from an excel based process to a QuickBooks computerized accounting system. The latter enables PPDC to maintain more accurate, timely, and reliable periodic financial reports required by donors and PPDC management/Board when making strategic and operational decisions.

- PPDC has seen enhanced financial planning through standard financial planning tools introduced by Humentum.

- PPDC has updated its financial management policies and procedures manual and procurement manuals, with support from Humentum.

- PPDC has seen improved internal control practices, including the preparation of monthly bank reconciliations for all active bank accounts.

The QuickBooks software training organized for the finance team made the transition process of our financial recording from the use of excel to QuickBooks software seamless. Access to the Humentum resources (such as the Need Assessment tools, financial management guide, financing strategy development tools, financing strategy toolkit checklist, etc.) enhances the finance team’s continuous development. These resources serve as a guide for the PPDC finance policy development, and their facilitator is well informed and always willing to assist. – Nkemdilim Ilo

Over time PPDC should note improved overall financial management best practices and efficiencies as it implements the standard financial management systems, tools, and procedures. In addition, PPDC should see increased funding inflow and operational sustainability due to a high level of accountability and transparency because of the improved financial management systems within the organization.

**Many thanks to the PPDC team for their insightful inputs.