Each time fraud at a well-known non-governmental organization makes headlines, NGO financial leaders are reminded once again of the critical importance of transparency and internal controls. Most frauds involving NGOs are not the result of operating sham organizations, but rather they are frauds perpetrated against great organizations from within by a few dishonest employees.

The Association of Certified Fraud Examiners (ACFE) estimates that organizations lose 5% of annual revenues to fraud. According to the latest report from Giving USA, the not-for-profit sector raised nearly $428 billion dollars in contributions in 2018, so more than $21 billion dollars was likely lost to nonprofit frauds.

Nonprofit management consultant Marion Lee, of Lee + Associates, eloquently summarized how fraud at a nonprofit reaches beyond the finances to threaten organizational mission:

For more than 20 years, Sage Intacct has helped NGOs and other nonprofit organizations increase transparency and visibility through the use of financial management technology. By becoming more data driven, NGO financial leaders can spot patterns of potential abuse and establish tighter internal controls to protect their missions from fraud.

Lack of internal controls can destroy your mission

Researchers at the University of Dayton studied 115 nonprofit organizations that had suffered a publicized fraud. Within three years of the fraud incident, 25% of these nonprofits had closed down. Younger nonprofits were more likely to fail, with the authors noting “newer nonprofits may also lack the structure, systems and routines that older organizations typically possess.”

In its 2018 Report to the Nations, ACFE revealed that internal control weaknesses were responsible for 42% of fraud instances in organizations with fewer than 100 employees. Smaller organizations suffered a median loss of $200,000 per fraud incident—nearly twice as much as larger organizations. In many cases, nonprofits lack the processes and technology required to establish sufficient internal controls for detecting fraud.

When it comes to detecting fraud, spreadsheets don’t cut it

Entry-level accounting software usually does not provide NGO financial leaders with the kind of financial reports they need to run the organization. Many organizations settle for pulling data out of the accounting system into an Excel spreadsheet. Not only are spreadsheets less reliable than real-time reporting in a robust nonprofit financial management solution, but spreadsheets can leave nonprofits more vulnerable to fraud.

Nearly 90% of spreadsheets contain errors, according to studies by PwC and KPMG. They also require too much manual manipulation, making them wildly inefficient. But the biggest problem with using spreadsheets is that they are easily manipulated and leave no audit trail. Any bad actor in your organization with access to reports could hide their fraud by manually changing the reports.

How Nonprofit Accounting Software Can Strengthen Internal Controls and Help Fight Fraud at NGOs

There are many ways that a cloud-based financial management solution can help NGOs establish and support internal control processes:

1. Audit trails

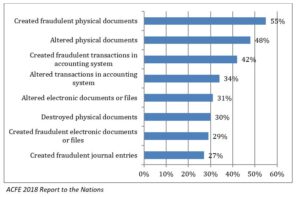

According to the ACFE Report to the Nations, only 97% of fraud cases involve some attempt by the perpetrator to conceal evidence of the fraud. Here are the top eight methods of concealment used in internal frauds:

If a nonprofit organization uses a financial management solution with an audit trail, it tracks which user changes or creates financial transactions or creates a journal entry. If fraud occurs, it is easy to identify the last person associated with the fraudulent transaction.

2. Automated approval routing

With fewer employees, smaller NGOs may rely too heavily on a single person to fill multiple roles. If one accounting person does it all—paying vendors, depositing funds, reviewing bank statements—the risk of long-standing undetected fraud runs higher than if duties were delegated to several people.

In one case highlighted by ACFE, a smaller nonprofit trusted a single bookkeeper with the longest tenure on the staff. The bookkeeper stole approximately $2.8 million dollars over the course of a ten-year scheme of writing herself checks coded to an obscure G/L account and then manually changing the bank statement printouts by pasting a vendors name over her own and then making photocopies. The fraud went undiscovered by two separate CPA firms.

A robust nonprofit financial management system will include the ability to set up automated approval rules that cannot be changed without the appropriate user access permissions. For example, expenses can be routed automatically to supervisors for authorization or checks for large amounts can require executive sign off.

3. Role-based secure access control

A financial management solution should allow an organization to set up permissions based on a user’s role, preventing them from accessing financial data from areas of the organization that are not relevant to their jobs. This helps establish a separation of duties and also prevents a dishonest employee from posing as somebody else while in the system.

4. Real-time Reporting and Dashboards

With a cloud-based financial management solution, it is possible to provide real-time reporting and visual dashboards across the organization to executives, program leaders, managers and other employees. This makes is harder for an employee to falsify financial records, because reports change in real-time based on the information in the database. Dashboards provide an easy way to executives to monitor spending and drill down into granular if any financial indicators appear suspicious.

5. Accounts Payable automation

Of the frauds that occurred within charitable organizations, 40% involved payables, according to the ACFE, making fraudulent disbursements the top vulnerability in a nonprofit organization. Automating AP processes can improve efficiency while delivering real-time, accurate fund visibility and reporting to many users.

A cloud accounts payable solution lets NGO executives and managers track and view payments, approvals, and reports—anytime, anywhere. In real-time, financial managers can review accounts payable liabilities and vendor-aging reports, as well as bill and check register reports across the organization. To enhance accuracy and save time, cloud financial management solutions should offer the ability to sync up with popular bill payment applications or credit card providers, so that the finance and accounting team doesn’t have to enter payables information into two separate systems.

Conclusion

Grantors and donors count on NGOs to use all funding to the highest purpose. When internal fraud occurs, it is a breach of trust with donors, co-workers and the communities served. The best fraud prevention involves strengthening internal controls to more proactively monitor transactions and expenses in real-time. Cloud-based nonprofit accounting software supports best practices for internal controls through real-time visibility, audit trails, security features, and AP automation.

Nonprofit finance leaders need internal controls and real-time reporting tools to prevent fraud. Learn more by reading the eBook, Secrets to Gaining Visibility into Nonprofit Financials.

___________________

Joan Benson, Director, Nonprofit Industry Marketing at Sage Intacct, has 25+ years of combined experience in accounting, publishing, and technology. In her role at Sage Intacct, Joan focuses on understanding the needs of nonprofit organizations by creating solutions, support, and best practices that help ensure mission success.

*Sage Intacct is a Humentum Industry Partner