Dilemma: should new international financial reporting guidance be driven by donor rules or accounting principles?

An accountant friend of mine in Uganda recently shared her struggle with me, “You learn all your accounting theory and qualify as ACCA or CPA, but then, being an accountant for a non-profit, it’s as if you have to ignore everything you’ve learnt!”

The reality for many non-profit-organisations (NPOs) is that donors are the most influential users of their financial reports. In order to receive the next tranche of funding, many NPOs are required to submit regular financial reports, in the format required by each donor.

Donor reporting requirements and formats vary, with some being more prescriptive than others. Donor requirements also often diverge from the accounting principles that accountants study as part of their professional training. Professional accounting exams are based on the accounting standards adopted in their country and are usually related to International Financial Reporting Standards (IFRS).

There are valid reasons why donor requirements may differ from accounting standards:

- Project or organisation. Donors are often interested in the visible accountability for funds they have contributed for a specific project; while IFRS give guidance on how to prepare the general purpose reports of the organisation as a whole. Donors may not be able to see their own project funding within organisation-wide financial reports.

- Cash or accruals. Donors often want to see the flow of cash: the amount received from that donor, the amount spent and the balance in the bank. The focus on cash is to mitigate fraud risks and to help calculate the amount to be sent in the next tranche of funds. Conversely, IFRS require accrual based reporting, which gives a more holistic picture of the organisation’s financial position and performance.

- Comparison to budget or previous year. Donor reports usually compare the actual amount spent to the agreed budget, while IFRS require comparison to the previous year’s expenditure.

- Expenditure classification. Donor reports may require expenditure to be classified using their own coding structure, or activities in the budget. IFRS does not prescribe detailed expenditure classifications, but some jurisdictions require particular expenditure lines for regulatory purposes.

- Direct and indirect costs. Donor reports often make a distinction between direct project costs and indirect costs that are needed to run the organisation as a whole. IFRS does not define those terms or require any disclosures relating to them.

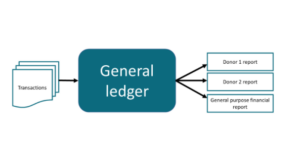

- The challenge for many NPOs is that their single accounting system, or ‘general ledger’ needs to produce all these different reports.

Well-resourced organisations can invest in sophisticated accounting packages with multi-dimensional coding functions, which can produce reports with different expenditure classifications, in different currencies, and on both cash and accrual bases. But an accounting package alone isn’t enough; organisations also need appropriately skilled finance staff, robust governance structures to oversee those staff, and the necessary IT infrastructure.

Smaller local organisations, which are the focus of the 2015 Grand Bargain localisation commitments, and which do the lion’s share of social sector implementation and delivery, typically lack the resources to invest in such a sophisticated accounting system. This is in part because they are predominantly donor funded, yet the finance function is perceived by many donors as an ‘overhead’ that is incorrectly associated with phrases like: ‘inefficient’, ‘unnecessary’ and ‘taking money away from front line service delivery’.

Since it is difficult, and in some cases, impossible for organisations to simultaneously meet the requirements of both donors and IFRS, many NPOs are effectively caught between two forces outside their control. Some organisations structure their accounting systems to meet IFRS type reporting needs, only to spend hours separately re-analysing project transactions in spreadsheets. Others structure their accounting systems to meet donor needs, but then struggle to produce meaningful whole-organisation financial reports.

This presents us with a quandary at the IFR4NPO project, where we are developing Internationally applicable Financial Reporting guidance for Non-Profit-Organisations. Our goal is to produce specific guidance for the non-profit sector that is based on international accounting standards.

This axis of debate, around donor requirements vs. a principle-based approach, proved to be a recurring theme at the latest IFR4NPO Practitioner Advisory Group meeting, which was held over two days in December 2019, in Nairobi, Kenya.

Arguments for a principle-based approach include:

- A holistic presentation of an organisation’s financial performance and position (alongside a narrative report explaining its public benefit impact) is considered to be more meaningful for a wide range of stakeholders and different types of NPOs.

- Donors have created their own prescriptive formats partly because there is no other applicable international framework for them to use. Once such a framework is in place, donors would have the option to use or align to that.

- There is considerable difference between different donors – it is not possible to align to them all.

- If whole-organisation reports include appropriate financial information about donor funded projects, the risk of ‘double funding’ is reduced and the opportunity to obtain more transparency about indirect costs becomes a reality.

Arguments for accommodating donor requirements include:

- Theoretical considerations aside, in practical terms, if compliance with the new guidance creates conflict with donor requirements, organisations will inevitably comply with donor needs to secure the funding they depend on to deliver their missions.

- Cash basis reports (as required by most donors) are less complex from an accounting perspective, and thus enable more organisations to comply.

- Resolving this dilemma may be the single biggest challenge facing the IFR4NPO initiative. The project offers, for the first time, an opportunity for the donor and accounting standard communities to do some intense listening, reflection and consultation.

- It was no one’s intention for NPOs to be stuck in the middle, effectively pulled in different directions by conflicting reporting requirements. So let’s create an environment where NPOs can instead focus on their urgent missions to make the world a better place.

- It’s imperative that we find a meaningful solution, because, as the saying goes: ‘When the elephants fight, it is the grass that suffers’.

The IFR4NPO project launched in July 2019. It is an initiative of Humentum and the Chartered Institute of Public Finance and Accountancy (CIPFA) to develop internationally applicable financial reporting guidance for non profit organisations by 2024. www.ifr4npo.org | info@ifr4npo.org