In today’s environment, NGOs continue to struggle to find new funding sources. One way to secure your NGO’s financial future is to strengthen financial management and improve transparency for donors. Good visibility into financial performance, solid insights, and a smart financial plan help earn (and keep) the trust of important donors.

Financial reporting is a time-consuming, inefficient and highly manual process for many NGOs. If your organization has multiple legal entities, multiple locations, multiple asset types, and/or multiple currencies, preparing consolidated financials can drag out close timelines. This is especially true if your team relies heavily on spreadsheets. Consolidation is a process usually measured in weeks but rarely in days. A better accounting system makes it possible to complete global consolidations in hours or minutes.

Consolidated financial statements group together all the related entities (locations, subsidiaries, etc.) under a single NGO’s control. This provides organizational leaders and the board of directors with a unified view of performance across operations. But the fast-moving and shifting needs of modern NGOs mean the financial management system needs to become a source of real-time operational and financial intelligence, not simply a system of record.

Today, many multi-entity NGOs are increasing the efficiency and quality of financial reporting with a modern cloud financial management solution. In addition to automating tasks like journal entries, a modern cloud financial management solution can also automate bank reconciliations, allocations, currency conversions, consolidations, and more.

Automate consolidations for a faster close

Closing the books faster means being able to put financial performance data to work sooner. Leaders benefit from fresher insights for decision-making. And donors receive everything needed to make funding decisions more quickly.

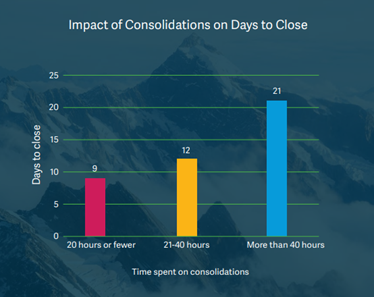

What’s standing in the way of a fast, efficient close? For many NGOs, performing consolidations is a major hurdle. It’s not an easy task, particularly if the finance team doesn’t have financial software capable of handling complexities, including decentralized payables, inter-entity transactions, and multiple currencies.

According to the Sage Intacct 2021 Close the Books Survey, organizations with more entities prefer working with a cloud financial management system. Three times as many respondents with five or more entities were using a cloud solution over spreadsheets and entry-level accounting software. What’s more, those respondents were closing their books two days faster with cloud financial management despite having more complex financial operations.

Cloud technology also enables continuous multi-entity consolidation accounting. By automating intercompany eliminations at the point of consolidation and performing currency conversions in real-time, you can also view interim summary financials at any time. Increase your visibility with fully up-to-date local and global reports.

NGOs shorten time to close, improving financial visibility

Automating consolidation activities, including currency conversions, inter-entity eliminations, and local tax reporting, eliminates hours to days of manual work and helps NGOs close the books faster. Here’s how three international NGOs have told us that cloud financial management with automated consolidations has benefited them:

Vitamin Angels is working to improve nutrition worldwide. The NGO partners with local organizations, including governments, to reach the most under-served, nutritionally vulnerable populations – pregnant women, infants, and young children – with evidence-based nutrition interventions. Although the nonprofit maintains a presence in over 70 countries, the accounting team was tracking international entities using Excel spreadsheets.

Vitamin Angels replaced manual, paper-based accounting processes with a cloud financial management system to bring its services to more women and children while minimizing administrative burden. The nonprofit streamlined its multi-currency, multi-entity accounting processes and adopted financial best practices. Accounting for multi-currency transactions, inter-company transactions, and global consolidations is now completely automated within their accounting system, replacing an onerous spreadsheet. The NGO enjoys a faster, more consistent close. Additionally, Vitamin Angel’s financial automation makes it easier to expand into new countries and set up separate entities to meet each country’s compliance and reporting requirements.

Room to Read is an international nonprofit that has improved literacy and girls’ education worldwide. The NGO collaborates with governments and other partner organizations to deliver positive outcomes at scale—benefiting more than 23 million children in 48,000 communities worldwide. Room to Read has experienced tremendous growth over the past decade, and it relies on a lot of automation to help it scale with that growth. Among many integrated solutions, the nonprofit uses cloud accounting software after switching from a server-based on-premises accounting system.

Today, with multi-entity, multi-currency accounting automation, Room to Read delivers global support for accounting and finance staff anywhere in the world. Cloud financial management eliminated huge Excel spreadsheets that required many hours of duplicate data entry in distributed field offices and the organization’s headquarters. By streamlining consolidations across 25 entities and 19 currencies, the NGO is saving time for both the local and international accounting teams, and improving visibility for executives, board members and donors.

The White Ribbon Alliance is a global network of maternal health advocates. It’s a nonpartisan, nonprofit and non-governmental membership organization aiming to decrease maternal and newborn deaths globally. There are over 150 countries in its international coalition, and the NGO has different entities in the US, UK, Nigeria, and Tanzania. The organization adopted cloud accounting software to achieve more efficient multi-entity and multi-currency accounting

The nonprofit quickly automated foreign currency conversions and vast amounts of manual work such as journal entries. With a more manual system, managing and documenting multi-currency travel expense reimbursements, bill payments, donations, and other transaction conversions required a multi-day process. After automation, the process takes less than 30 minutes. The accounting team slashed the time spent on currency conversions by 95% and now close the books 90% faster.

Conclusion

For many NGOs, financial data is plentiful, yet time is scarce. To improve efficiency and visibility, NGOs are leveraging cloud-based financial management technology across traditionally time-intensive functions, including financial reporting. For organizations with international accounting complexities and multiple entities, the automation of financial consolidations in the cloud offers many benefits, including a faster close, more reliable reporting, and a continuously updated view of consolidated performance. To further explore the ways cloud accounting software can strengthen insights and deliver a faster close, please download The Modern Nonprofit Chart of Accounts eBook.

Learn more about our Industry Partners

© Photo: Shutterstock/maradon 333