Understanding the nonprofit sector’s challenges today is key to successfully navigating the insurance marketplace. In our latest Nonprofit Sector report, 12 articles shed light on emerging trends and the implications for nonprofits amid a world of change. Whether operating in North America or anywhere around the globe, this will be a year where success is defined by leadership’s ability to think more holistically as they address multiple challenges in the wake of COVID-19.

Overcoming Obstacles by Changing Your View

As people (and organizations), we seek routine, comfort, peace, and tranquility. We develop blind spots, a stuck mindset, or, more relevant today, misinformation and misguided advice that can distract our organizations into decline and/or reduced impact and value.

Despite our differences, this pandemic has been a wake-up call as to how connected we are.. Time also has been a gift in our world of risk management, as we have learned so much about what safe environments for children mean, and what diversity, equity, and inclusion are really about. As leaders, we need to move beyond surface repairs and envision entirely new ways to deliver services.

We have an opportunity to embrace these challenges as thresholds of change through three different overriding principles:

Recognizing the Vital Nature of Relationships

We must recognize the importance of collaboration—boards, committees, teams, departments, communities, regions, associations. Young and old, educated and streetwise, faith-based and secular. We are truly so interconnected, but perhaps duplicative in our approaches as well.

Thinking Holistically

Specialization has its merits and value, but we also need to think outside the box and not limit ourselves to our department, organization, or industry. Coalitions can be empowering and impactful, especially complementary partnerships.

Understanding That Risk Is Powerful

Thanks to remarkable advances in data analytics, risk is no longer something we should necessarily avoid—we can analyze and move forward to enhanced stability and strength based on good data. In fact, risk is the ultimate underpinning of all change. We have to rethink our business planning and continuity assumptions, which is risk management.

Together, we can all build the necessary capacity, align ourselves with specialized professional partners, and see risk as the oil for the change engines we need to become for our missions and our societies.

Confronting Workforce Challenges

The Colorado Nonprofit Association conducted a study titled “Nonprofit Workforce Impacts: Reflections from Colorado Nonprofit Association” to better understand COVID-19 impacts on the people working for nonprofits that can help guide organizations toward maintaining engaged workforces. We can glean a number of insights from this study.

For example, the majority of the workforce experienced increased workload and number of job functions due to COVID-19. The following chart shows the percentage of respondents that stated a rise in these areas:

- Salary or Wages 25%

- Number of Hours Working per Week 47%

- Number of Job Functions 66%

- Workload 69%

The increase in responsibilities combined with workload has led to increased anxiety within the workforce. As a result, according to the study, the majority of the workforce felt anxious and burned out at the beginning of 2021. Other insights from the study indicated that more than a quarter of those with increased workloads and job functions had to do more with the same amount or less time. And the majority (75%) saw no change in wages or salary.

Despite the responses listed above, 89% of the workforce indicated that they had been supported by the nonprofit community somewhat well or better.

- Not at All Well 11%

- Somewhat Well 45%

- Moderately Well 26%

- Very Well 18%

So how do we move the continuum from not at all well up to very well? The Colorado Nonprofit Association offers the following suggestions:

- Offer trainings and opportunities that address the human side of working in the nonprofit sector

- Send communications that reflect personal and professional experiences

- Advocate on issues that impact the nonprofit sector and workforce

- Cultivate partnerships where we can both challenge and be challenged to think differently about how to support people

Additionally, leaders can help move the needle with a carefully crafted organizational strategy, including physical, emotional, career, and financial wellbeing. Taking a more holistic and comprehensive approach to employee wellbeing and communication will optimize investments in total rewards and foster better connectivity of individual contributions to organizational success.

Navigating the Challenging Cyber Insurance Market

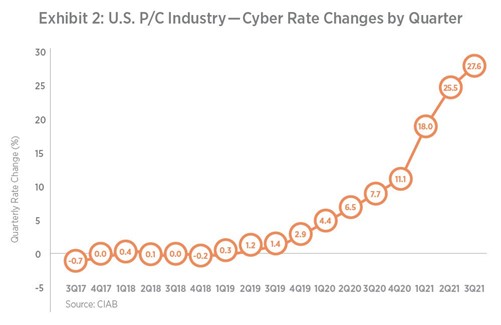

Throughout 2021, the tough cyber insurance market impacted virtually every industry sector. As the pace of cyber attacks intensifies and increased cyber claim payouts continue, cyber insurance carriers are responding. The news isn’t good for policyholders, including those in the nonprofit sector.

A recent report showed that a Russian hacking group had targeted more than 150 organizations worldwide, 25% of which were involved in international development, humanitarian and human rights work. This particular attack involved phishing emails designed to get victims to download malware or hand over sensitive data. It’s no surprise that hackers are targeting nonprofits, as they often hold significant amounts of data that can be monetized, including donor banking records, payment cards and personally identifiable information.

The reaction from cyber underwriters has been swift, and nonprofits are being subject to rate increases and decreased capacity. Moreover, those that are provided coverage terms are often finding that cyber insurance policies now contain coinsurance provisions, sub limits, and exclusionary language that can restrict coverage.

To prepare for what has become the most challenging cyber insurance market on record, nonprofits should focus on key data security controls, including multifactor authentication, backup data encryption, and proper staff training.

By adhering to these and other network security best practices, nonprofits will be able to demonstrate to the cyber underwriting community that they are actively managing cyber risk, which should ultimately position them for more favorable results as they navigate the cyber insurance marketplace.

Conclusion

Despite the challenges facing the nonprofit sector today, there are myriad opportunities to help keep emerging exposures under control. From staying on top of the latest nonprofit sector trends, and proactively reassessing and implementing risk control measures, to empowering your leadership to drive meaningful workforce change, 2022 has the potential to be a very strong year in which organizations and their people grow stronger, together.

Disclaimer

The information contained herein is offered as insurance Industry guidance and provided as an overview of current market risks and available coverages and is intended for discussion purposes only. This publication is not intended to offer legal advice or client-specific risk management advice. Any description of insurance coverages is not meant to interpret specific coverages that your company may already have in place or that may be generally available. General insurance descriptions contained herein do not include complete Insurance policy definitions, terms, and/or conditions, and should not be relied on for coverage interpretation. Actual insurance policies must always be consulted for full coverage details and analysis.

Insurance brokerage and related services to be provided by Arthur J. Gallagher Risk Management Services, Inc. (License No. 0D69293) and/or its affiliate Arthur J. Gallagher & Co. Insurance Brokers of California, Inc. (License No. 0726293).